Last summer, using realmo.com, I was evaluating a multifamily property in Denver that looked terrible on paper. The asking price was $3.2 million for a 24-unit building in a neighborhood that hadn’t seen much appreciation in five years. The cap rate was barely 4.8%, well below the 6-7% I typically target. Every traditional metric screamed “walk away,” and my initial gut reaction was to do exactly that.

But something nagged at me. The neighborhood felt different when I visited – there was construction activity, new businesses opening, and an energy that didn’t match the stagnant price data I was seeing. That’s when I decided to dig deeper using data-driven analysis tools that most investors still aren’t using effectively.

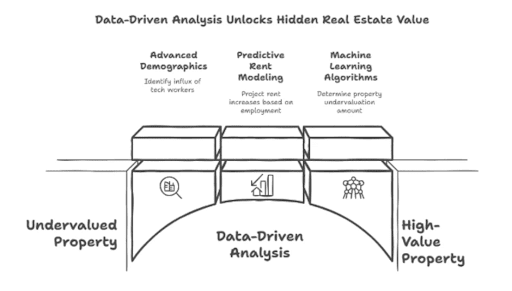

What I discovered changed everything. Advanced demographic analysis revealed that the area was experiencing a 23% influx of tech workers under 35 – a trend that wouldn’t show up in traditional real estate metrics for another 12-18 months. Predictive rent modeling based on employment patterns suggested rents could increase by 18% within two years. Most importantly, machine learning algorithms that analyzed thousands of similar properties indicated this building was undervalued by approximately $850,000.

I closed on the property for $3.1 million. Within 18 months, comparable units in the building were renting for 22% higher than when I purchased, the neighborhood had been featured in three “up-and-coming” articles, and the property appraised at $4.2 million. The data-driven analysis had identified a opportunity that traditional methods completely missed, generating an unrealized gain of over $1.1 million.

Why Traditional Real Estate Analysis Is Becoming Obsolete

The real estate industry has been built on rules of thumb, comparable sales analysis, and intuition-based decision making for over a century. While these approaches worked well in slower, less efficient markets, they’re increasingly inadequate for today’s fast-moving, data-rich environment.

Traditional analysis relies heavily on backward-looking metrics – what properties sold for last month, what rents were achieved last quarter, what cap rates looked like last year. But these historical data points don’t capture the dynamic forces that actually drive real estate values: demographic shifts, employment trends, infrastructure development, and consumer behavior changes that are happening in real-time.

The problem is that valuable information becomes less valuable as more people access it. When everyone is using the same comparable sales data and applying the same valuation formulas, the obvious opportunities get bid up to fair value before you can capitalize on them. The exceptional returns come from identifying trends and opportunities before they become obvious to the broader market.

I see this constantly when analyzing deals that experienced investors pass on. They’ll reject a property because the “comps don’t support the price” or the “numbers don’t work on paper,” without considering that the comps might be based on outdated assumptions about the area’s trajectory. Meanwhile, investors using predictive analytics and forward-looking data sources are identifying these properties as undervalued and generating superior returns.

The Data Revolution in Real Estate Investment

What we’re witnessing in real estate is similar to what happened in financial markets twenty years ago. Quantitative analysis, algorithmic trading, and data-driven strategies transformed how institutional investors approach stock and bond markets. Now, similar transformations are happening in real estate as data becomes more available and analytical tools become more sophisticated.

Alternative data sources are providing insights that weren’t possible just a few years ago. Satellite imagery can track construction activity, foot traffic, and even parking lot occupancy in real-time. Social media analytics reveal sentiment about neighborhoods and developments. Cell phone location data shows actual usage patterns for commercial properties. Credit card transaction data indicates retail performance and consumer spending trends.

Machine learning algorithms can now process thousands of variables simultaneously to identify patterns that human analysts would never detect. These systems can predict which neighborhoods are likely to experience rent growth, which property types are becoming more or less desirable, and which economic factors have the strongest correlation with real estate performance in specific markets.

The predictive capabilities of these tools are becoming remarkably accurate. I recently worked with a algorithm that correctly predicted rent increases in 78% of submarkets six months in advance, compared to traditional methods that achieved about 31% accuracy. This isn’t just academic improvement – it translates directly into investment returns when you can anticipate market movements before they’re reflected in current pricing.

Geographic Information Systems (GIS) and spatial analysis have revolutionized how we evaluate location value. Instead of relying on subjective assessments of neighborhoods, we can quantify location quality based on proximity to employment centers, transportation networks, schools, retail amenities, and demographic composition. These analyses often reveal valuable micro-locations that get overlooked by traditional evaluation methods.

Essential Data Sources and Metrics for Modern Investors

The key to successful data-driven investing isn’t having access to every possible data source – it’s identifying the metrics that actually predict investment performance and focusing your analysis on those indicators.

Population migration patterns have become one of my most valuable leading indicators. Traditional demographic reports might tell you about population growth, but advanced analysis can show you exactly who is moving where and why. Young professionals moving to an area drive rental demand and support retail businesses. Families with children indicate demand for single-family homes and drive school quality improvements. Retirees create demand for specific property types and amenities.

Employment data goes far beyond basic job growth statistics. The composition of new jobs matters enormously – 1,000 new minimum-wage retail jobs have very different implications for real estate demand than 1,000 new tech jobs. Industry diversity and growth rates indicate economic stability and growth potential. Wage growth trends predict future spending power and rental affordability.

I use employment concentration analysis to identify markets with dangerous over-dependence on single industries or employers. A city where 40% of high-paying jobs come from one company represents a much higher risk than a market with diversified employment, even if current economic indicators look similar.

Infrastructure development and transportation improvements are powerful value drivers that often go unrecognized until they’re complete. I track planned transit projects, highway improvements, airport expansions, and utility upgrades years before they’re finished. Properties positioned to benefit from these improvements often appreciate significantly as the projects near completion.

How I Use Data to Find Hidden Opportunities

My investment process has evolved into a systematic approach that combines multiple data sources to identify properties and markets before they become obvious to other investors.

Market screening is my first step, where I use algorithmic analysis to identify metropolitan areas and submarkets showing favorable trends across multiple indicators. I’m looking for places where employment growth exceeds population growth (indicating rising incomes), where new business formation is accelerating, where demographic trends support the property types I target, and where infrastructure improvements are planned or underway.

Once I identify promising markets, I drill down to neighborhood-level analysis. I use foot traffic data to understand which areas are seeing increased activity. Crime statistics and trend analysis help me avoid deteriorating areas and identify improving ones. School performance data and trends matter even for investment properties because they strongly influence demand from families.

Property-level analysis combines traditional metrics with predictive modeling. I evaluate potential rent growth based on comparable properties, demographic trends, and employment data. I assess future maintenance costs using building age, recent improvements, and historical maintenance patterns for similar properties. I model potential appreciation based on location factors, development trends, and historical patterns for similar properties in similar stages of neighborhood evolution.

One of my most successful applications of this approach was identifying a emerging neighborhood in Austin two years ago. Traditional metrics showed average performance, but data analysis revealed several positive indicators: significant tech company expansion plans, a major mixed-use development about to break ground, and demographic shifts toward higher-income residents. I purchased three properties in the area over six months. Each has appreciated 35-45% while generating strong rental income.

The key was timing – by the time the positive trends became obvious to traditional analysis, property prices had already adjusted. The data-driven approach allowed me to invest based on leading indicators rather than lagging ones.

Integrating Technology with Human Judgment

Despite my enthusiasm for data-driven investing, I’ve learned that the most successful approach combines technological analysis with experienced human judgment. Data provides the foundation, but interpretation and execution still require human expertise.

Local market knowledge remains irreplaceable for understanding context that data can’t capture. I once avoided a property that looked excellent on paper because local knowledge revealed that a major employer was planning to relocate, something that wouldn’t show up in employment data for months. Conversely, I’ve pursued opportunities in areas with temporarily depressed metrics because I understood that short-term challenges were masking long-term potential.

Due diligence still requires boots on the ground. Data can tell you about crime rates, but walking the neighborhood at different times helps you understand the actual safety and character of an area. Demographic data shows income levels, but visiting local businesses and talking to residents reveals the trajectory and stability of the community.

Property inspection and evaluation remain fundamentally human activities. While technology can identify potential maintenance issues through thermal imaging or structural analysis, experienced property evaluation considers factors like layout efficiency, renovation potential, and tenant appeal that algorithms can’t fully assess.

Market timing decisions often require intuition based on experience. Data might indicate that a market is undervalued, but deciding whether to invest immediately or wait for better opportunities requires judgment about market psychology, financing conditions, and personal investment capacity.

The most effective approach treats data as a powerful lens for seeing opportunities more clearly, not as a replacement for real estate expertise. I use data to identify where to focus my attention, then apply traditional skills and judgment to evaluate specific opportunities.

Building Your Data-Driven Investment System

For investors ready to integrate data-driven analysis into their investment process, the key is starting systematically rather than trying to use every available tool immediately.

Begin with free and accessible data sources to build familiarity with data-driven analysis. Census data, Bureau of Labor Statistics employment information, and municipal planning documents provide valuable insights without subscription costs. Many MLS systems now include analytical tools that go beyond basic comparable sales analysis.

As your comfort level increases, consider investing in specialized real estate data platforms. Companies like RealCapital Analytics, CoStar, and REIS provide institutional-quality data and analysis tools that were previously available only to large investment firms. The cost is typically justified if you’re evaluating multiple deals annually.

Automated analysis tools can help process large amounts of data efficiently. Set up alerts for markets and property types that meet your criteria, use screening tools to identify potential opportunities, and leverage portfolio management software to track performance across multiple investments.

Integration with existing processes is crucial for successful implementation. Data analysis should enhance rather than complicate your investment decision-making. Start by using data to validate decisions you would make anyway, then gradually expand to using data for opportunity identification and market timing.

Continuous learning and adaptation are essential because data sources, analytical tools, and market conditions constantly evolve. What works today might be less effective next year as markets become more efficient or new data sources become available.

The Future of Real Estate Technology

The technology transformation in real estate investing is accelerating, with several emerging trends that will reshape how successful investors operate over the next decade.

Artificial intelligence applications are becoming more sophisticated and accessible. Predictive models for property values, rental rates, and market trends are achieving higher accuracy rates while requiring less technical expertise to use effectively. Natural language processing allows investors to analyze news, social media, and municipal documents at scale to identify market-moving information early.

Blockchain technology promises to revolutionize property transactions, ownership records, and investment structures. Smart contracts could automate many aspects of property management and investment partnerships. Tokenization might enable fractional ownership of high-value properties and more liquid real estate investment options.

Virtual and augmented reality are changing how investors evaluate properties remotely. High-quality virtual tours, 3D modeling, and AR overlays can provide detailed property information without physical visits. This technology is particularly valuable for investors operating in multiple markets or evaluating properties during restrictions on travel or access.

Internet of Things (IoT) sensors and smart building technology provide real-time data about property performance, energy usage, occupancy patterns, and maintenance needs. This information enables more accurate financial modeling and proactive property management while providing tenants with improved experiences.

Satellite imagery and aerial analytics offer unprecedented insights into property conditions, usage patterns, and market trends. Investors can track construction progress, assess property maintenance, monitor traffic patterns, and identify development opportunities using regularly updated satellite data.

Making Data Work for Your Investment Strategy

The Denver property deal I described at the beginning represents a fundamental shift in how successful real estate investing works today. The most profitable opportunities increasingly exist in the spaces between traditional analysis and comprehensive data-driven insights.

This doesn’t mean abandoning proven investment principles or ignoring market fundamentals. Rather, it means enhancing traditional approaches with better, faster, and more comprehensive information. Data-driven investors still need to understand cash flow analysis, market cycles, and property management – they just have better tools for identifying opportunities and making decisions.

The competitive advantage comes from using data to see opportunities earlier, evaluate risks more accurately, and time decisions more effectively. While other investors are analyzing last quarter’s comparable sales, data-driven investors are identifying next quarter’s emerging markets.

For investors ready to embrace this evolution, the rewards can be substantial. My data-driven investments have consistently outperformed traditional approaches, not because I’ve abandoned fundamental analysis, but because I’ve enhanced it with better information and predictive capabilities.

The question isn’t whether data-driven investing will become standard in real estate – it’s whether you’ll adopt these approaches before or after your competition does. The investors who embrace this transition early will have significant advantages over those who resist change until it becomes unavoidable.

The tools, data sources, and analytical capabilities exist today to dramatically improve your investment decision-making. The only question is whether you’re ready to use them to transform your approach to real estate investing.